Patriotic Millionaires:

Can Taxing the Rich Save America?

Recently, members of Peyk’s editorial board were invited, along with other members of the Iranian American community, to a presentation by the Patriotic Millionaires entitled: Tax the Rich! Save America. Patriotic Millionaires is a self-described non-partisan advocacy group made up of high net worth individuals in the U.S. who promote public policy solutions to encourage political equality and seek to restructure the American tax system so that the wealthy (including themselves) will pay a greater share of the tax burden. The group was founded in 2010 and first came to prominence when they called for the end of the Bush-era tax cuts.

Morris Pearl, chairman of the board of Patriotic Millionaires, took questions and answers after the presentation, which covered topics found in his 2021 book co-authored with Erica Payne (founder and president of Patriotic Millionaires), entitled Tax the Rich: How Lies, Loopholes, and Lobbyists Make the Rich Even Richer.

The presentation was timely as Congress has been considering President Biden’s “Build Back Better” agenda, a plan to create jobs, cut taxes, and lower costs for working families—all paid for by making the tax code fairer and making the wealthiest Americans and large corporations pay their fair share.

After the meeting, Peyk caught up with Mr. Pearl to ask a few questions for the benefit of Peyk’s readers. Peyk does not specifically endorse Mr. Pearl’s comments; these questions and answers are for informational purposes for our readers. The interview has been edited for space and clarity.

–Peyk Editorial Board

____________________________________________________

Peyk: Thank you for taking the time to join us, Mr. Pearl. It was a pleasure hearing you speak at a recent presentation. Will you tell us about what prompted you to write your book, Tax the Rich?

Morris Pearl (MP): Our nation is experiencing inequality and it is becoming increasingly destabilized. We are seeing many of our neighbors succumbing to deaths of despair, becoming addicted to opioids, and just giving up—because they are becoming more and more aware that the economy is rigged and that they cannot make it. The American Dream is no longer alive for them. They have given up hope of living like their parents lived, much less doing better.

I want to do something about that. I want my granddaughter to grow up in a nation filled with people who can work for a living and make enough money to support their families and pay their bills and have some money left over for a few luxuries like premium ice cream. Because that is the nation where I grew up and was able to invest and do well. Gross inequality does not work well over the long term. They tried that in South Africa when I was a teenager. It did not end well for the rich people.

Peyk: Let’s back up to where you say that the American economy is rigged. What do you mean by that?

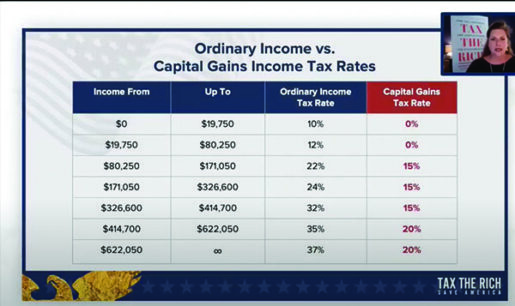

MP: I mean that the rules are set so that those people who are rich tend to get richer, and those people who are not tend not to get richer. Our political and economic system favors the rich. The obvious example (and a main point of our book) is that income derived from capital is taxed at substantially lower rates than income derived from labor.

Another example is that our nation has strict regulations on labor unions, restraining the ability of workers to organize with each other in order to bargain as a unit with an employer who employs many workers, but the capitalists are not constrained by regulation.

Peyk: You mentioned that investment income is taxed at a lower rate than the income tax associated with labor, which is part of your explanation about why the rich are not being taxed enough. Was it always this way and what led to the laws being changed to favor investment income?

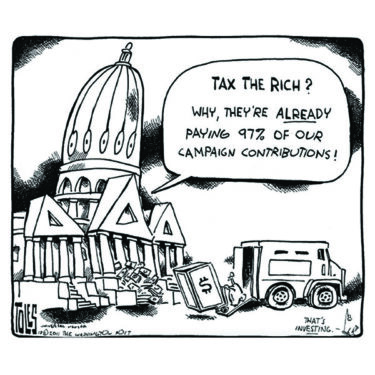

MP: Tax rates have gone up and down over time, and I do not read people’s minds so I cannot tell you what was going through the minds of the policy makers in the past. For the record, the rates for labor and investments had been equal as recently as the late 1980s. I ascribe the policies to a few possible causes:

Elected officials spend huge amounts of time raising money, and therefore spend a lot of time hanging out with and talking to the major donors. That means that they become very familiar with whatever it is that frustrates and annoys their donors. And taxes on capital investments are very visible—instead of money being deducted from a paycheck, the investor actually has to take out a check and a pen and write out the check and sign it and mail it in. A lot of people don’t like that, so their elected officials have come up with special benefits for being an investor. And those special benefits have an enormous compounding effect. By not paying taxes on my investment gains every year, I am—every single year—wealthier than I would otherwise have been, and that means that I actually have more investment gains each year than would have otherwise been the case. Lower taxes lead to higher balances, higher balances lead to more income, and more income leads to higher balances the following year—a cycle that works very well for those people who have the good fortune to be wealthy.

The other issue is a fiction that a few people have been propagating that the government has to encourage people to invest, because rich people will go on strike unless the government comes up with policies to appease them. That does not make any sense. Think about it for a moment from the point of view of someone who has millions of dollars of savings. The person could take all their money in cash and stick in a safe in their house. That would result in no taxes (because they would have no income). Or, the person could invest in very conservative investments (government bonds or something similar) or the person could invest in stocks. We live in a capitalistic society with a more-or-less free market, so the market rates of different investments go up and down as supply and demand for investments shift. However, it makes sense to invest money, whatever the tax rate. If the tax rate is 20%, I would rather have some income and pay 20% in taxes and keep the other 80%. If the tax rate is 80%, I would rather have some income and pay 80% in taxes and keep the other 20%. As long as the tax rate is not 100%, paying the tax is always better than not having any income.

Peyk: What can average Americans do to reverse the decades-long trend of increasing wealth and income inequality?

MP: Americans can and should call their senators and representatives, and insist that they do something about it. If their elected representatives do not agree with them, they should elect different representatives.

Peyk: Thank you for your time.

____________________________________________________

Prior to his work with Patriotic Millionaires, Morris Pearl was a managing director at BlackRock, one of the largest investment firms in the world. His work included the Maiden Lane transactions and assessing governments’ potential losses from bank bailouts in the United States and in Europe. Prior to BlackRock, Mr. Pearl had a long tenure on Wall Street where he invented some of the securitization technology connecting America’s capital markets to consumers in need of credit. He is a CFA (Chartered Financial Analyst) Charter Holder, a member of the CFA Institute, the New York Society of Securities Analysts, and on the board of Verified Voting and The Center for Political Accountability.

More information can be found at the Patriotic Millionaires website: https://patrioticmillionaires.org/